Listen now

At NGP Capital, we have followed the robotics market closely since 2019. It took us three years to get to our first robotics investment in SVT Robotics and four years for our second investment in ANYbotics which we announced in May this year. Why did it take so long? Although the market was interesting already in 2019, we believe that today’s environment represents a perfect storm for the next wave of innovation and growth in the robotics market.

Why now?

1) A step change in performance improvement and cost decline of underlying technologies such as sensors, AI and simulation capabilities has unlocked more unstructured and collaborative use cases. This is a stark contrast compared to the prior waves of high volumes and standardized, goods in isolated or highly predictable environments.

2) Sticky demand drivers due to structural workforce shortages exemplified by the US being projected to leave 2.1M jobs unfilled by 2030 in manufacturing alone.

We believe that these drivers will create a bigger wave of future winners compared to the most recent wave around mobile logistics robots with the likes of Exotec and Locus Robotics.

Escaping the cages

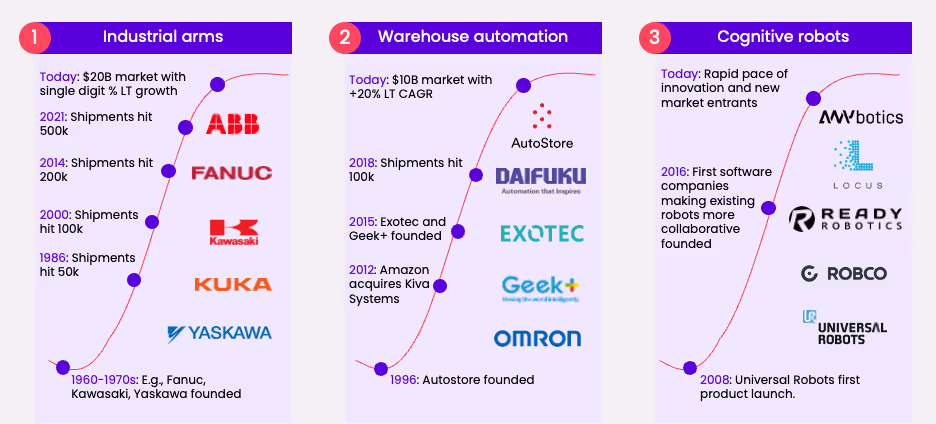

First wave: industrial robot arms

Robots at industrial scale have been around since the 1980s but remained mostly limited to industrial robot arms for the automotive and electronics industries for decades. This wave of robotics was all about high volumes and standardization to make the economics work and is largely occupied by long-term industry leaders; ABB, Fanuc, KUKA, and Yaskawa. Despite representing a $20B+ global market, most US factories are yet to adopt robots.

Second wave: Automation of logistics

The signs of a second wave started to emerge around 2010. Warehouse automation was the main target market this time around. First with AGVs (automated guided vehicles) that follow visual guidelines or cube-based goods retrieval systems, and later with AMRs (Autonomous Mobile Robots). It took, however, close to a decade before the second wave grew to a large market. For example, segment leader Autostore was founded in 1996, but it wasn’t until 2018 that the company crossed $100M in annual revenues. Four years later, Autostore generated $584M of revenues with an impressive 78% YoY growth, indicating that the market saturation is far from its peak.

The relatively early nature of the warehouse automation segment is further illustrated by the parallel success of goods-to-person robotics provider Exotec which was founded in 2015, almost 20 years later than Autostore. AMR companies like Locus Robotics founded in 2014, is among the first robotics companies that were truly collaborative with human workers and compatible with the rest of the operating environment.

Third wave: Cognitive robotics

Locus Robotics is a leading indicator for the third wave of robotics which we believe will be centered around robots with improved cognitive capabilities. This, we believe will lead to the biggest wave of robotics adoption to date.

Our definition of cognitive robotics is characterized by robots that can perceive their surroundings, adjust to changes in real-time, and are equipped with simple human-robot user interfaces. The benefits of these capabilities should yield reduced friction for both robotics deployment as well as usage and unlock new robotics markets at industrial scale. From our perspective, the cognitive capabilities of next-generation robots will enable truly human collaborative robots across a wide range of use cases. A stark contrast to high volume, high repeat use cases targeted by the first wave of robotics companies as well as the traditional definition of cobots which remains widely used to describe robot arms that can operate next to human workers without a cage.

Our investment in ANYbotics exemplifies cognitive robotics; the robot can operate together with people, perceive and act on changes in its environment, across a wide range of complex industrial settings and use cases while being easy to operate. Other examples of companies building fundamentally cognitive robotics include the likes of Robco, Neura Robotics, Figure, and many more. But what is driving the capabilities of cognitive robots and why do we believe that will result in the biggest wave of robotics adoption to date?

Moving towards a ChatGPT moment for physical automation

ChatGPT consumerized AI, but what isn’t equally discussed is the impact that the AI evolution has on the physical world.

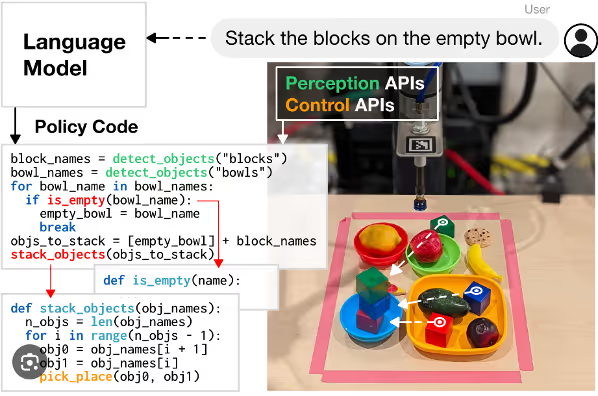

An example of how large language models play an interesting part in robotics is the work by Google Deepmind. The team at Deepmind recently released RT-2, a vision language action model trained on text and images from the web and allows to turn this data into robotics. This represents a radical change in speed and flexibility to train and program robots compared to incumbent industrial robot arms. Now, this is certainly not the first attempt at addressing this problem and companies like Ready Robotics and Wandelbots have raised large rounds of financing to tackle the same problem. What is different now compared to for example in 2019, is that this is the first time that LLMs shift the potential to use natural language interfaces with robots instead of proprietary programming languages while leveraging publicly available data. How LLMs or VLMs will be adopted at scale in robotics remains to be seen but nevertheless represents an intriguing technological evolution.

In addition to VLMs or LLMs that allow for no-code user interfaces, significant additional technology leaps have occurred during the last years that improve the cognitive capabilities of robots. For instance, this video of Boston Dynamics over 30 years is a great illustration of how long progress historically has taken, and how fast we are currently moving. More powerful simulation capabilities, advancements in synthetic data, sensors, and reinforcement learning models make robotics increasingly available out of the box for a wider range of use cases than ever before as robots independently can adapt to changing real-world conditions in real-time. We believe that these technological advancements enable cognitive robots that will change robotics towards a truly human collaborative technology with significantly lower user friction across many more categories than today.

What we look for

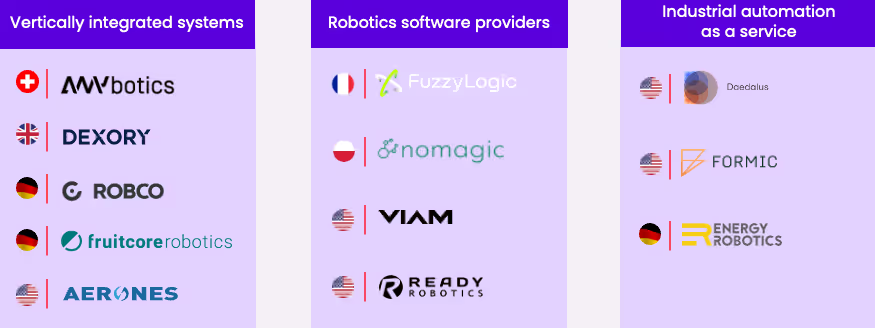

Industry maturity for robotics varies significantly depending on the form factor and target market. For instance, industrial robot arms for automotive is one of the most mature categories and as such more than 50% of the industrial arm market is owned by five key players. With the exception of the automotive and electronics sectors, robotics is a highly fragmented and largely unpenetrated market. As such we see a wide range of attractive investment opportunities aligned with our cognitive robotics thesis across three categories:

1) Full stack vertically systems like ANYbotics, Robco, or Aerones that create new robotics categories.

2) Robotics software providers that make it easier and faster to adopt and use robotics such as our portfolio company SVT Robotics.

3) Companies integrating existing best-in-class solutions with a proprietary software layer with a full-suite services value proposition like Formic.

As a VC firm investing from Series A through Series C rounds, we understand that it can be challenging for founders in robotics to assess if NGP Capital is the right fit from a stage perspective. Especially at the Series A stage. For the sake of transparency, the following aspects describe the key points that feed into our evaluation of stage and product-market fit with our investment strategy:

1) How many robots have been deployed? Preferably double-digit deployments beyond pilot projects.

2) What is the usage of deployed robots? Data that shows how the product or system has become embedded in daily end-user workflows.

3) How are the deployed robots performing? Regardless of full stack or software provider, we hope to see numbers on how the deployed robots are performing from an uptime perspective and compared to customer expectations.

4) What is the booking to revenue conversion? We consider this a leading indicator for the level of productization or how little customization is required for each deployment as well as supply chain scalability and performance for full-stack companies. All of which impacts growth predictability, capital efficiency, and customer satisfaction.

5) Are there repeat customers? Do customers keep coming back for more is a key data point that we look for to validate that the customer problem is being solved.

Now, we naturally don’t apply the same benchmarks across Series A to Series C, but this hopefully provides an idea of what we prioritize when evaluating stage fit for NGP Capital and robotics investments.

Having followed the market for years, we know that robotics is not the easiest of technologies or markets to crack, but we firmly believe that current technology and demand trends are setting robotics up for the widest wave of robotics adoption to date. The companies that do master the complexities of a robotics company will be equipped with inherent moats for the long run. We have tremendous respect for founders that have the grit and passion to take on the complexity of solving real-world problems with automation. As we’ve heard from people in the know – robotics is frustrating by nature.

With robotics being a perfect fit with our firm-wide convergence thesis, we aim to make several robotics investments and would love to hear from founders, operators, and fellow investors with an interest in the space.

.svg)

.svg)