Listen now

Revenues at Heptagon plummeted to zero as the global economy teetered in the wake of the financial crisis in 2007 and 2008. The company had little cash reserves and funding was scarce following the collapse of prominent financial institutions such as Lehman Brothers and Washington Mutual. The Board held an emergency meeting and considered whether to sell, fold or double down.

With few good options, Heptagon’s Board helped arrange an emergency capital infusion, albeit at a fraction of the valuation ascribed just one year earlier. The Board recruited new CEO Christian Tang-Jespersen, who helped turn around the company. Heptagon ultimately raised over $200 million and sold for over $1 billion in 2016.

While as many as 75% of venture-backed companies failed following the financial crisis, Heptagon succeeded largely due to unflinching support from a couple key investors, including NGP Capital.

Startup Boards can make or break businesses and may tip the balance between success and failure during crucible moments. Often their influence is profound. As my partner Bo Ilsoe articulately noted, CEOs should craft a Board with the same care that one builds a management team.

Yet too often Board building is an afterthought, a residual of fundraising. In our recent survey of over one hundred portfolio companies, NGP Capital found that most Boards add value but up to 25% are ineffective. We also found that company success is highly correlated with Board effectiveness.

Effective Boards are capable, coordinated, collegial and concentrated on company success. Board Directors bring diverse perspectives with expert insight on key business matters yet align on what is best for the business. They have ‘noses in, but fingers out’ meaning they are highly engaged and well-informed, yet respect that management runs the business. They offer strategic perspective, source talent, facilitate partnerships, balance growth and capital efficiency, and reinforce accountability.

Having served on dozens of Boards, including those of seven unicorns, I have been fortunate to work with many astute Directors and seen how great Boards can augment and occasionally alter company outcomes. Based on our collective experience at NGP Capital across over one hundred investments, following are five points to consider as you build your startup board.

1. Recruit top board talent

Simple in concept, hard in practice. Lead investors typically require a Board seat as a funding condition, so startup Boards comprised primarily of early investors are the norm. Investor Directors have fiduciary duties to both portfolio companies and their limited partners, which usually coincide but often conflict at key junctures in the life of a startup. When interests diverge, fund interests prevail. When startups falter, for example, funds often replace a busy senior partner with a junior investor or abdicate altogether further complicating an already precarious situation.

Many investors bring valuable insight and experience through pattern recognition across many startups, yet overreliance on VCs as Directors is a lost opportunity. Correlation Ventures reviewed over 31,000 venture financings across two decades and found that startups with more than three venture Directors under performed. Having too many VC cooks in the kitchen may crowd out other perspectives.

Founders can mitigate this risk but only if they build Boards thoughtfully from inception. Rather than filling startup Boards with cofounders and friends, founders should instead recruit Independent Directors who bring industry experience or functional expertise relevant to key issues faced by the company. Independent Directors who combine expertise with a shareholder mentality can better balance investor prerogatives and mediate sticky situations when investor and company interests diverge.

Recruiting an Independent Director is like a lottery pick or star free agent signing on a basketball team: both can alter the team dynamic and dramatically improve team prospects. Like free agent signings, term limits – say three to five years – for Independent Directors reinforce good performance and allow flexibility to recruit new talent as business needs change.

Independent Director term limits also establish a precedent for investors. Lead investors often require Board rights for the life of their investment, yet they may be more flexible if the startup is performing well and can see that the Board is in good hands.

Among our portfolio companies, more than half recruited Independent Directors at or before their Series A round. Strategic and product guidance from these Independent Directors have proved invaluable in positioning companies for success and, in a couple cases, premium early exits.

2. Boards evolve with the needs of the business

Startup Boards are dynamic. Each new funding round brings new investors. The vast literature on public boards is less relevant to startups as venture firms oversee their investments directly, while public Board Directors act as surrogates for broad shareholder interests. Nevertheless, Boards should adjust to align with business needs, and governance should evolve toward a public board model as a company grows.

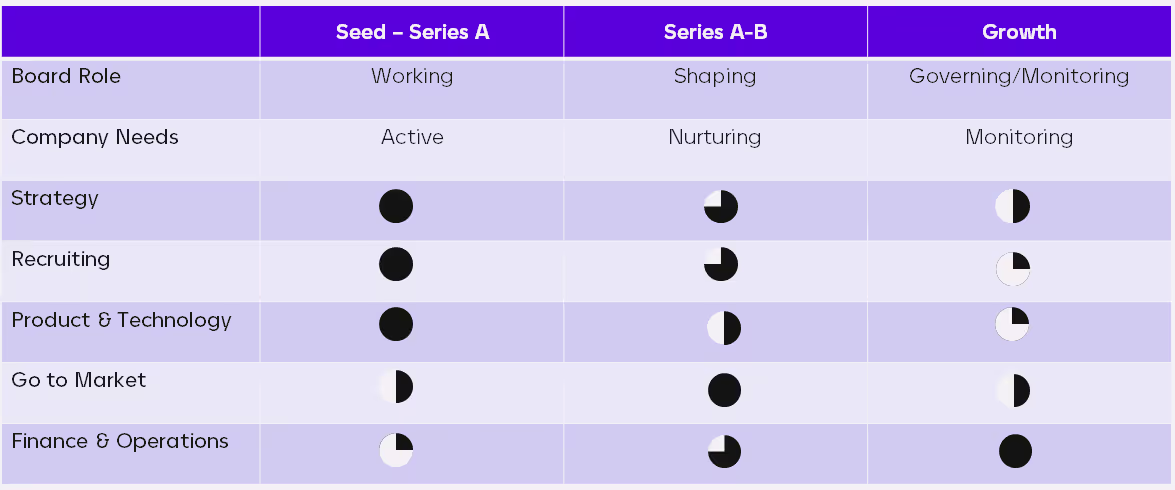

In Startup Boards, Feld and Blumberg identify three phases of Board development as a startup matures from seed to growth stage. Seed stage startups focus on the formative tasks of identifying a compelling market opportunity, recruiting relevant talent, and developing a product that fulfills market demand. Series A and B companies focus on product market fit establishing a repeatable go to market motion with a newly recruited sales team. Growth stage companies focus on scaling operations, improving unit economics, achieving market leadership, and building a predictable business.

Table 1: The Evolving Role of the Board as a Company Develops

Board members and investors require different skills at these three business stages. Seed investors focus on Founder Fit and help startups by sourcing early-stage talent. Series A and B investors focus on Product Market Fit bring business development, product management and marketing skills vital to refining the product and go to market motion. Growth stage investors focus on financial metrics with the operational capacity to help scale businesses efficiently.

Thoughtful CEOs will recruit Directors with expertise aligned with these business needs. Good seed stage investors often leave a Board after the Series A or B round to make room for growth stage investors and redeploy their efforts with startups requiring their distinct skills. Independent Directors with fixed terms offer flexibility to realign Board expertise with company needs.

3. Board composition: balanced & small

Small, cohesive Boards are best, yet Boards have ballooned as a byproduct of increased funding. Venture backed Boards a decade ago were typically capped at seven Directors. Many growth stage Board meetings today have doubled in size.

Among our active portfolio, 35% have raised over $100 million and 40% have Boards with eight or more Directors. The number of Board observers often exceeds Directors. Add senior management to the mix and Board meetings expand to twenty or more people of which most are investors. Large meetings can devolve into quarterly reports featuring keynote addresses from senior management. These meetings frustrate both executives and Directors.

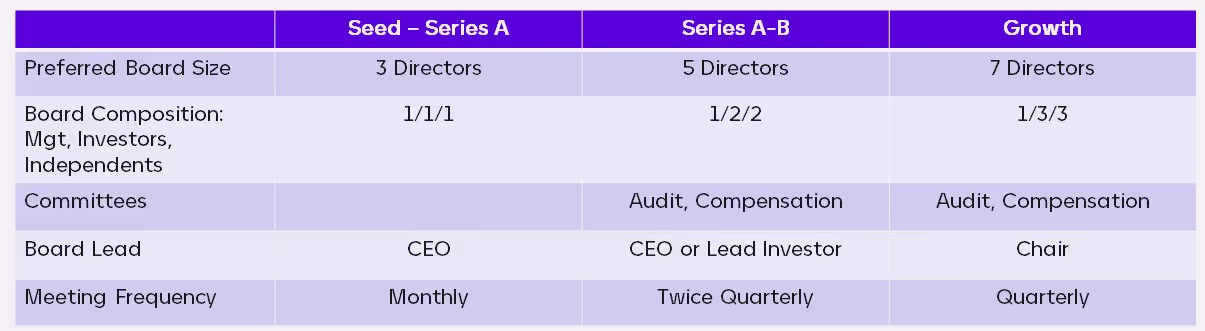

An alternative model is to apply the rule of one: one company Board representative – the CEO; one Independent Director for each venture Director added; and one non-executive Chair. Table 2 illustrates how Board composition may evolve as the company grows.

Table 2: Board Evolution as a Company Grows

Maintaining a small Board requires discipline and a thoughtful strategy to ensure investors are well informed. While this is no easy task when insistent investors offer large checks, Boards and companies perform better when they do. Recruiting non-executive chairs, introducing committees, managing meeting tempo, and bolstering reporting are all strategies for maintaining effective Boards as the investor base grows.

Workfusion offers a good example of a growth stage company that has maintained a cohesive Board while raising over $350 million in seven rounds. The CEO recruited a non-executive Chair, balanced Independent and Investor Directors, and managed Director succession planning well as the company has grown. Investor Directors have recycled in each of the last three rounds and the company has recruited new Investor Directors as the needs of the business have evolved.

4. Non-executive chairs

Non-executive Chairs are standard for public Boards and common among growth stage companies. CEOs lead Boards in 80% of our early-stage companies, while non-executive Chairs or lead investors lead Boards in over 40% of our growth stage companies. Growth stage company Boards with non-executive Chairs in our portfolio outperform those that are CEO led.

Non-executive Chairs help manage Boards and free the CEO to focus on the daily tasks of running a business. The Chairperson advises the CEO on Board matters, manages the Board agenda, facilitates Board engagement, reinforces Board culture, mediates differences of opinion and ensures alignment. She also helps the CEO process feedback, especially during non-executive sessions where the Board provides feedback after the CEO has recused himself.

CEO Theodore Nielsen recruited Christian Tang-Jespersen as Chairman of NILTechnology following our investment. Christian brought relevant experience from Heptagon and has formed a strong partnership with Theodore instilling a cohesive Board culture, refining NILT strategy and accelerating business growth.

5. Strategies for dealing with large Boards and many shareholders

Investors and management share a common interest in startup success. Investors have a vested interest in adding value, and as does management in tapping resources that helps them win. Much of this value-added work occurs outside Board meetings.

Informed shareholders can serve as effective ambassadors and add value regardless of their engagement level in the business. Investor relations, a common practice among public companies, also applies to private companies. Informed, satisfied investors area business asset, especially when new funding is required. A robust reporting system and scalable investor engagement model provides the foundation and forum to tap shareholder value.

Lime, which has raised over $1 billion through six financing rounds, is best-in-class for a private company managing many shareholders. Lime retains an intimate, small Board alongside a robust shareholder engagement model. Like a public company, the CEO and management team hold quarterly calls with major shareholders and is highly responsive through an its investor relations and executive team where appropriate.

Many companies leverage advisory boards that provide input on company and product strategy separate from Boards of Directors. We have been impressed with the active engagement that Pubmatic and Immuta enjoy with their Customer Advisory Boards and how these discussions inform product road map and new product features. Their annual customer meetings double as selling opportunities with prospective customers and investors that showcase new products and features that emerge from these Customer Advisory Board sessions.

Startup Boards meet monthly to quarterly depending on business needs. Our companies average two meetings quarterly at the early stage and meet quarterly at the growth stage. Boards meet less frequently as companies scale, develop more predictable performance, and apportion responsibilities through Board committees.

Boards typically add audit and compensation committees after their Series B financing rounds. Audit committees ensure tax and legal compliance. Compensation committees seek to align management and shareholder interests while establishing a culture of accountability in annual budgeting and financial management.

- - -

Effective Boards are an asset to any business. For startups navigating among large incumbents in rapidly changing markets, expert Boards can tip the balance between success and failure. CEOs should build a Board recruiting talent with the same care that one constructs a management team.

Here we have outlined five strategies for building an effective Board. In the second article in this series, we will discuss how to craft a Board culture that best utilizes the assembled talent.

.svg)

.svg)